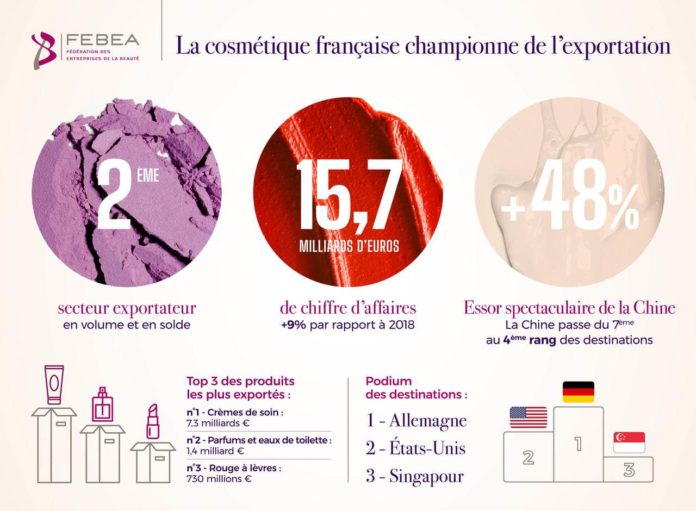

The 2019 Customs figures were published this morning and announced by the Secretary of State for Foreign Trade. The cosmetics industry turned in a fine performance internationally in 2019: the sector exported nearly €16 billion worth of products, up 9% on 2018. This growth, which has been sustained for over 10 years, makes cosmetics France's second-largest export sector. Europe remains the leading market for French cosmetics, ahead of the United States. China is enjoying spectacular growth, with exports up 48% in one year. Skin care, followed by perfumes and eaux de toilette, are the most popular products worldwide. The dynamic, innovative industry exports over 50% of its production, and this export activity alone represents 130,000 jobs in France.

- The second-largest export sector, cosmetics sales account for more than 150 Airbus

France's foreign trade results for 2019 have just been published by Customs. The French cosmetics industry is enjoying remarkable success: in 2019, it exported €15.7 billion worth of products (the equivalent of more than 150 Airbus aircraft), confirming France's position as world leader in cosmetics. These excellent results place the industry in second place among France's export sectors, behind aeronautics.

Cosmetics "made in France" also appeal strongly to foreign tourists: for every 5 cosmetics products sold in France, 1 is purchased by a foreign visitor.

In total, over 50% of production is exported, and the cosmetics export business alone employs 130,000 men and women throughout France.

- French cosmetics acclaimed the world over

Europe is the world's leading region in terms of exports. It is followed by the United States, then Asia, whose share is growing spectacularly. Exports to China jumped in 2019 by almost 50% (+48%). China thus moves up from 7th to 4th place among destinations for French cosmetics. There was also a sharp increase in exports to South Korea (+ 26%) and Singapore (+ 16%). Today, one French cosmetics product in 5 is sold in Asia.

Top 3 export sales: skincare, fragrances and lipsticks

Skincare products are the biggest export sellers, accounting for over €7.3 billion, an increase of more than 46 % over the last 5 years.

Perfumes and eaux de toilette are also extremely popular: export sales (over €4.8 billion) have risen by 23% in 5 years.

Sales of lip make-up products, which have risen by almost 80% in 5 years, total over €730 million.

- A dynamic and innovative sector

Every year, more than a third of cosmetic products are renewed.

The sector is innovating in two major directions:

- As far as products are concerned, we are witnessing a strong breakthrough for natural and organic products. Many brands, both large groups and SMEs, are reformulating their products to enrich them with natural ingredients, in response to a major consumer demand.

- Another key trend is personalization. Skincare products, fragrances and make-up are increasingly tailored to individual needs, and many formulas are now developed with the help of AI: a "scan" of the consumer's skin enables us to offer them the product that corresponds exactly to their skin type and color, but also to the climatic conditions and context in which the product will be used.

- When it comes to packaging, eco-design is the watchword. Brands are working to reduce the weight and size of their packaging, and are developing major innovations: insert tubes, refillable bottles, glass containers or containers made from 100% recycled or plant-based plastics.

The FEBEA encourages the widespread adoption of these projects, in particular through the SPICE program (Sustainable Packaging Initiative for Cosmetics), a sustainable packaging initiative for the entire industry.

- Success that lasts, thanks to solid foundations

If French cosmetics export figures have been rising by an average of 10% a year since 2013, it's also thanks to a high-performance ecosystem at every level.

France is a leader at every level of the value chain:

- Research - into ingredients, raw materials, formulations and packaging - is world-class, thanks to the excellent training of French engineers and researchers, and the strength of our network of research and training centers. The sector's R&D is the most efficient in France, with 3.6 patents filed per million euros spent. Cosmetic Valley is a recognized center of excellence in this field.

- French-style cosmetics retailing, for its part, boasts a complementarity that is unique in the world: having four distinct distribution networks (supermarkets/pharmacies/perfumeries/salons) has enabled brands to develop specific, high-performance ranges in each retail format.

This success is also due to the sector's entrepreneurial dynamism," adds Patrick O'Quin, President of the FEBEA. Every year, 170 new cosmetics companies are created in the industry, fueled by the sector's abundant innovation. Alongside the world-renowned major groups, our industry is made up of some 85% small and medium-sized businesses throughout France. Particularly in regions that have been able to capitalize on their historic expertise in perfumes - Provence, for example - or their natural riches: Brittany in particular, thanks to the success of cosmetic ingredients derived from the sea".

Thanks to this export performance, the French cosmetics industry now holds 23% of world market share. Made in France" remains an essential asset for the sector and for our economy as a whole.